Bitcoin is correcting sharply, as expected. From this episode, we learn (again) that bitcoin is not magic and is not a get-rich-quick scheme, and that the bitcoin financial ecosystem is still terribly insufficient to meet demand.

As I walked off a flight yesterday, the correction was already in progress. Worse, all the trading tools (bitcoinity, bitcoincharts, mtgox) were offline and/or unreachable while the correction kept being in progress. That is not just unacceptable; that is a joke for something that makes the claim to be a billion dollar market.

In my last article about how bitcoin weren’t there yet, I highlighted the dependence on the largest exchange, MtGox, as an example of faults with the ecosystem. This correction certainly highlighted how that was true beyond my suggestions – an exchange that has a ten-minute lag in trading orders at best, and is completely unreachable at worst, can barely be taken seriously as a hobby project – and certainly not as the main hub of a next-generation billion-dollar trading system. MtGox shutting down trading mid-correction was just the icing on the cake that confirmed this.

The crux of it is that MtGox’s dominant status isn’t good for the bitcoin ecosystem, and therefore paradoxically, not for them, either. You’d rather have a 20% market share on a trillion-dollar market than an 80% share on a billion-dollar market. I would argue it’s in MtGox’s interest to foster a competition between itself and other exchanges, in order to grow the overall market. Ideally, we’d see a cross-exchange protocol develop that would make exchanging resilient as well as increase overall trade, like when mobile carriers enabled inter-carrier text messaging and increased traffic dramatically.

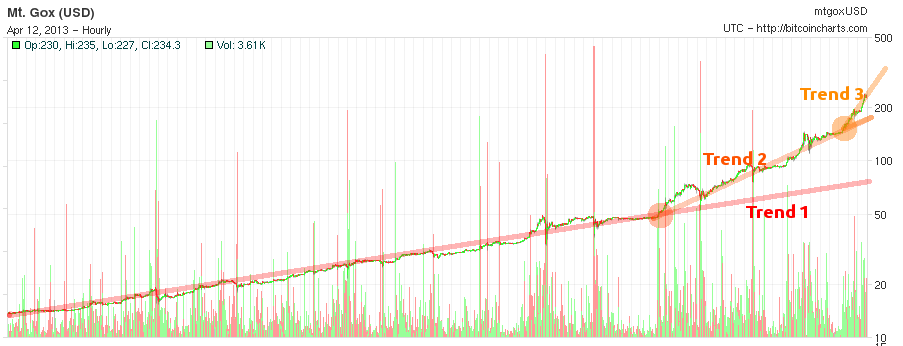

We can observe that bitcoin had gone absolutely bonkers in the past month, following an already-strong value appreciation (red trend), roughly doubling every month. In the last sharp correction in 2011, bitcoin quadrupled in two weeks before that correction. Therefore, as bitcoin hit overdrive and went into doubling-every-week mode, as it had done in 2011, I expected a correction was imminent. I had set a sell target a few days out, based on that pattern from 2011, but the correction hit before the sell target. That can obviously happen and is part of the game.

Still, my position in bitcoin is and remains long term (decades).

This chart shows the past three months of bitcoin, just prior to the correction. Around new year’s, it went from being flat to appreciating slowly but steadily as the FinCEN guideline was published that confirmed bitcoin as a legitimate trading instrument. Then, as Cyprus hit, bitcoin’s value accelerated into Trend 2 on the chart. The past week has gone crazy with media waking up, creating yet another breakout into Trend 3. That trend had the same rate as the rate just before the 2011 correction and trend reversal.

I was worried when the exchange rate seemed to stabilize around $180 right after the correction, as that would mean the correction was only down from Trend 3 and down to Trend 2. That would mean the major correction hadn’t yet arrived and was still to come, at least as I read the chart.

I expect a continued fall of the exchange rate to at least the dominant trend, meaning a value of around $60-$65. [UPDATE: And so it did, right on cue.] Where it goes from there is anyone’s guess. This could be a trend reversal, or it could be a sharp correction with a continued uptrend. (Do note that I’m often wrong, and tend to sell low, buy high, and miss targets when I’m trying to catch short-term swings: see above.)

When I outlined bitcoin’s four hurdles as they looked in 2011, “Exchanges” was one of them. This concern remains, and has intensified as a clear obstacle to bitcoin’s credibility and – perhaps most importantly – trustability.

In the time between the last peak and now, we have gone from GPU mining to ASIC mining (via FPGA mining). ASICs were in the blueprint stage by the last peak, and so, resilience of the network itself has increased a lot. My point is that a lot of seed capital is going into bitcoin companies by now as business angels have fixed their eyes on bitcoin. Hopefully, by the next peak, the initiatives that started this spring will be operational enough to stabilize the ecosystem.

In the meantime, this was not the second peak, but something like the fourth or fifth similar event. We can be certain it is not the last.

Most importantly, failure or success of short-term speculation is irrelevant to bitcoin’s eventual success as a decentralized, resilient currency.

There is no need to repair the exchange rate or think in such terms. The reason I’m mentioning the exchange rate at all in this article is that the bitcoin trading, when it goes intense such as in this correction, puts a merciless spotlight on the inadequacies of the current bitcoin ecosystem.

The good news, as said, is that we may expect a lot of them to be fixed by the next time this happens. Maybe in the spring of 2015, maybe sooner, maybe later.

The author (still) has a significant position in bitcoin.

“The crux” sounds like Swenglish 😉 Anywho… Isn’t the “bridge” between the “real” world and the internet bitcoins weakest point? I mean, if noone could exchange bitcoins to “real” money then it can’t be anything else than a small internet-hype. I mean when the governments of the world realises what a threat this is and just shut down mtGox and the others…Offcourse you can still mine and exchange it for services but It wouldn’t really be a threat anymore if you really can’t exchange it. Or? What’s your thoughts on that?

It will be as you say for as long as most get their wages in kronor / USD – which will be for as long as most don’t know / care about BTC. But if people start losing trust in the fiat currencies, they will demand more and more kronor for the work, if they will even accept to get their wages in kronor any more. Would not be nice to be the last one sitting on a big pile of kronor when no one wants them anymore. Because then you couldn’t buy anything for them… Then they would basically be paper and scrap metal.

This is true for the moment, and only if you think of BTC as an investment.

BTC is not suited for this task (though it is a highly speculative and lucrative item for some), because it’s main strength is in transactions, and even micro transactions. Why should you care whether you can change BTC into USD when you don’t need USD to buy bread and electricity? All you need to do is spend and exchange BTC directly – problem solved.

For this same reason – benchmarking BTC against USD is bogus, because this is exactly what BTC works-around – the need for fiat currency. You cannot benchmark it against USD for the same reason BTC was brought into existence – FED can emit obscene amount of USD without creating any value, and it can certainly “buy” all BTC in existence with just a press of the button (and it wouldn’t be that expensive at the moment). This would of course make a few people rich and doesn’t stop yet another incarnation of BTC on a different network, so it would be pointless, but still proves the point that valuation of BTC should not be in the USD exchange rate but in the amount of “things” you can get for BTC.

As BTC gains momentum this will get clear, because fiat currencies will need to compete with it for payments – would you rather spend BTC or USD for your meal? Depends on how much of each you can get for the work you do or the product you sell – any other currency will inevitably fail when it comes to this, because you can’t tax what you can’t control…

Yes. You are right. It is very difficult for most of us to think away from fiat currency being “real money” which would be the only thing we could exchange for wares and services.

Although I must say I am a little bit at unease on the untaxability part. To most people I’m afraid it would be too radical to say “well, taxes… that is impossible, we will have to find new ways to finance firefighters, healthcare, education…”. At least it would be very radical in a country like Sweden 😛

i really hate these sites that lose your comment on submitting it!!!

Basically, the idea of tax evasion with bitcoin is silly, why it persists i dont know. The govt could simply change how it taxes people. Even if it didnt, their is a common and accepted practice already in place. *guessing*, Thats right, Guessing!

where i live they do it with my water bill, they sometimes check it and charge roughly the same based on previous water use. A common example of ‘guessing’ is a pizza shop, even if they cant track the money they can track the deliveries, Ex flour. they can guess at how much business they have by the estimate on how much pizza they make based on the flour they order to make it. its in that businesses best interest to keep good records so they gov’t doesnt ‘guess’ high and charge them more then they actually owe. in the case of my water bill, they sometimes guess high… i have to call them out to check it to get it corrected.

In regards to where taxs are spent, vary little goes to the public side of things, most goes to the military.

my guess is that the govt have to shift from income tax to usage tax (VAT). so they get some money whenever someone buys a product. this way the guy who pollutes the most, pays most.

[…] Rick Falkvinge – What We Learn From This Bitcoin Correction: […]

We also got rid of all the yuppies: http://www.youtube.com/watch?v=Shqgp4d7zk8

I’d rather we got rid of Max Keiser.

I always love reading your posts on Bitcoin. Frankly I agree with just about everything you say.

I like comparing Bitcoin to Linux, there is still only one (viable) distribution.

Have you read anything about colored coins? Check this link: http://www.bitcoinx.org/

I am very excited about the possibilities that colored coins present and foresee everything that has happened with Bitcoin up till now paling in comparison to when they gain traction.

There is also room for other protocols that act as a layer upon the Bitcoin protocol in the same way. I feel like at the moment Bitcoin is like trying to browse the internet using just HTTP and no web browser.

[…] Someone said: “Bitcoin is correcting sharply, as expected. From this episode, we learn (again) that bitcoin is not magic and is not a get-rich-quick scheme, and that the bitcoin financial ecosystem is still terribly insufficient to meet demand.” …http://falkvinge.net/2013/04/12/what-we-learn-from-this-bitcoin-correction/ […]

I’m frankly surprised it got as high as it did, I’ve been expecting this kind of correction since it reached 40 USD/BTC. Incidentally, I’ve asked others who were interested in bitcoin and never gotten much of an answer, how, in the future, will you deal with the inherent deflationary aspect of the currency? Ultimately, the early adopters are getting a damn good deal out of BTC, and have very little reason to ever liquidate since, assuming the currency goes mainstream, as demand goes up and supply stays static, they will always get a reasonably good investment out of simply sitting on their money. Your thoughts?

I don’t quite see this as a bad thing. The problem with the current mess is that the consumers – everything our wealth and prosperity is based on –

My personal desire to spend it would come from necessity or desire, like needing food, or wanting a new car. If early adopters retire on their coins, spending them is particularly necessary.

I do not see this as a neccessarily bad thing.

The current situation is bad, because the consumers – the basis for our economy – have driven up their living costs to an unsustainable level. The current situation is not sustainable, because sooner or later someone will have to pay the piper. Once that happens, every household with debts, simultaneously, will go bankrupt. Banks will refuse to give out new loans because they need to pay their creditors, and we’ll end up in a deflationary spiral which will destroy growth and prosperity for a long time.

A debt-based economy is a poorly suited for the future. It’s time we start thinking in new terms. Yes, bitcoin does encourage hoarding – but at the same time, most people will still spend some coins. Not all coins, mind you, but some. Others will invest their savings to make even more bitcoins which will increase in value. But the most important factor of it all; Bitcoins will be perfect for a sustainable, balanced economy and will make it very difficult to overspend the entire market’s resources.

I agree that moving away from a debt based system is a good idea, but I’m still inclined to say that a currency which rewards hoarding of all your money except what is necessary for day to day expenditures will have some long term weaknesses.

It has occurred to me that banks might eventually develop that would take in bitcoin investments and make loans, returning interest (or perhaps dividends in another currency) to the depositor.

Much like gold served this purpose for millennia.

I’m very interested in bitcoin development but at the same time very wary to join the club. I admit I never went into how it works and how do I keep my electronic wallet to actually hop in. Still I do hope it develops. The world needs a currency that’s impervious to Govt meddling.

I would not call an 80% move as correction…

It is not the downslope that is abnormal, it is the upslope. A value that reverts to where it was two weeks ago is normally a mild correction.

I feel bitcoin will continue to experience wild swings like this for a long time to come. There is absolutely nothing holding its value in place. Every actual good sold for bitcoin (which is something that could peg its price) is actually priced in dollars, converted to bitcoin at the latest exchange rate, thus failing to peg the bitcoin price.

You can’t blame merchants for not wanting to price a plasma TV at “10 bitcoin” no matter what the exchange rate, as that is currently a recipe for disaster. What a shame.

I’ve thought long and hard about realistic ways of fixing this, but it’s really tricky. The best thing I came up with is to have payment processors like BitPay introduce an intentional lag into their “convert payment to dollars” option. It would start out very low, but over time it would grow automatically. If implemented by all major payment processors, this would give bitcoin a value that’s somewhat pegged on the scale of the lag.

I’m not sure people are rational enough to accept this, however.

I see one big problem with bitcoin. Cost of running bitcoin network is proportional to it’s total capitalization. Miners mine 3600 new bitcoins every day, so when one bitcoin was worth $260 cost of operating network would be almost million dollars per day! Really expensive taking into consideration very little ‘real world use’ for bitcoin.

Even now, after 75% fall it is still 250k dolars per day. Does transaction volumes justify it?

One block is 10000 BTC. 25 BTC goes to the miners who mined that block. If BTC is higher then the miners get more $.

That’s what I was saying. Bitcoin users pays miners 25 BTC in every block. There is a new block every 10 minutes, so 144 blocks every day. 144 * 25 = 3600 BTC.

Suppose bitcoin will mak it to $1000. Bitcoin users would then pay miners 3.6 million dollars every day. That is not sustainable unless transaction volume goes up significantly.

No, users do not “pay” 25 BTC. There is 25 BTC inflation for every block. That’s a big difference, economy-wise.

This is because Bitcoin is still in its inflation phase. That changes slowly over time.

Users _do_ pay, the transaction fees, but that’s very far from 25 BTC per block. When inflation ceases the transaction fees are all that will encourage mining.

The users of the network don’t pay it.

What happens instead is that the amount of real-world resources devoted to mining converges on the monetary value of those 3600 BTC/day, since from a miner’s perspective the rest is just free money. Hardware is a sunk one-time cost so let’s ignore it for now, mining will keep increasing until the total cost of electricity burned reaches a significant portion of it. So yes, that could be as high as $2M/day in electricity costs when it saturates if BTC price was stable at $1000.

It would probably burn more electricity than the amount of real world items actually being exchanged for BTC’s. Almost the entire activity is people buying to hold forever, traders, and people moving coins back and forth to make the world believe it actually gets used for something

One block was 50 BTC but are now half of it 25 BTC. The miners get all 25 BTC. If BTC/USD is higher then more $ goes to the miners.

The users of the network don’t pay it.

What happens instead is that the amount of real-world resources devoted to mining converges on the monetary value of those 3600 BTC/day, since from a miner’s perspective the rest is just free money. Hardware is a sunk one-time cost so let’s ignore it for now, mining will keep increasing until the total cost of electricity burned on BTC network maintenance reaches a significant portion of it. So yes, that could be as high as $2M/day in electricity costs when it saturates if BTC price was stable at $1000.

It would probably burn more $ worth of electricity than the $ value of real world items actually being exchanged for BTC’s; and even if not, the overhead will be way worse than all the corruption of the existing financial system that BTC users love to hate. Almost the entire activity these days is from people buying to hold forever, traders, miners selling, and people moving coins back and forth to make the world believe it actually gets used for something.

Just consider ordinary electric radiators in a cold country.

There you have real burning of electrical energy without any use of the energy beforehand. It is a shame we haven’t found better ways to make use of that electricity before turning it into heat.

“the overhead will be way worse than all the corruption of the existing financial system that BTC users love to hate.”

Lol, no – probably not even close.

Using bitcoin purely for investment purposes is purely stupid.

The currency being in its initial stages needs people who increase its usability , open businesses around it , make it more mainstream and earn monthly salaries out of it .

This is not a currency yet to hoard thinking about its value in the future.

Ok so you cannot trust MtGox or another exchange to store your savings there in bitcoins. To maintain a wallet you have to backup that. There are many ‘?’ and we don’t know if BTC/USD will continue to increase as of before this jump or what it was so bitcoin is no investment to make money on shorter term as a couple of months.

To the author:

Such a protocol for connecting exchanges already exists, and it’s called FIX (Financial Information eXchange). (Google/DuckDuckGo it!)

I’ve programmed a FIX based trading system before and it’s not very hard to set up, all things considered. In particular, my system was for FX trading, so I know for a fact that would have to be done is to add BTC/USD (or USD/BTC) to the configuration, and voilà!

— Guy Who’d Love to Do the Programming

The media attention it got might still be useful.

Right now what it needs is not more people trying to profit from bitcoin, that led us to the bubble, but more people trusting bitcoin as a currency for their transactions to give bitcoin itself more use and more value as currency.

Bitcoin, in theory, is an amazing way to send money overseas or buy things online, more secure and efficient than credit cards or paypals but the structure just isn’t there.

And yeah, the exchangers are not yet sophisticated enough to support the growth of bitcoin.

There’s still a lot of work that needs to be done but it will get there I’m sure.

You learnt nothing from this crash.

Don’t you worry. Bitcoin will come back hard _soon_. We’re not talking about months or years here, just give it a couple of weeks. The other exchanges have got a lot of traction from MtGox, so MtGox isn’t as dominant anymore. Meanwhile I’m working very hard on a real interesting service based on Bitcoin that should shake things up a bit. Once new services arise it will bring Bitcoin value instead of speculation. Trust me on this. Working to 2AM everyday on this besides my regular 9-5 job. Right now working on making it DDoS foolproof. Once all the technical details are settled I’ll get some VC to accelerate this. Hold your Bitcoins! I’ll do whatever I can to increase your Bitcoin value.

I would like to know more about this service. I can tell you don’t want to give the concept away completely, but a hint would be nice.

It’s all about making it easy for online merchants to get paid in Bitcoins as well as ordinary people to pay with Bitcoins; the glue between merchants and consumers and making it user friendly for both parties. It is currently focused on micro payments, but not excluding higher values.

[email protected]…would love to know what your doing

Keep me updated

” Hold your Bitcoins! I’ll do whatever I can to increase your Bitcoin value.”

Oh no not another one who’ll work hard to artificially keep the value of Bitcoins up..

This is not a correction, but scam and bubble.

Imagine if I got my wage paid in bitcoins – 50% value of it – gone.

It is currency for scammers and speculators, not ordinary people.

I think it would be more like you got a raise of %100 for one month, and the next month your pay went back to where it was before (bitcoin is trading at $110 again)

Thank you – I’m better off with my ordinary currency – at least it’s value does not halve overnight.

Ordinary currencies like in the Weimar republic? 🙂

This Bitcoin correction will be nothing in comparison when the real world financial system collapses.

Yeah – so we all need to invest in your scam service…

All this talk about how bitcoins are safe from evil government and wall street money traders.

The fact is that currently the only benefiting from bitcoin are money traders and speculators who scam people out of their money using bubb..oh, i meant corrections, like this.

And drug users, and Argentinians who want to move money out of their country, and Spaniards who wish to protect their savings, and that Iranian student who is still able to get money from his parents in Iran despite sanctions, and multitude of Chinese and South American families who are able to get money sent home from family members in USA and Europe.

Well speculation can be done using any currency really.

What is different with cryptocurrencies is that governments and central banks can’t affect them by printing limitless amounts of new money and banks can’t be getting bailed out by taxes gathered by the state, since taxation is very difficult with cryptocurrencies.

In the current system, banks have an incentive to help bring in tax money because the same tax money is used to bail them out when their most recent epic gambling rampage fails.

[…] Rick Falkvinge – What We Learn From This Bitcoin Correction: […]

[…] Rick Falkvinge – What We Learn From This Bitcoin Correction: […]

[…] Original post by RT […]

OK Rick, would really like your opinion on the bitcoin story in this video: http://www.youtube.com/watch?v=Ks-snl4JM1U .

[…] See all stories on this topic […]

[…] Rick Falkvinge – What We Learn From This Bitcoin Correction: […]

Great article as usual Rick. I do agree that Bitcoin must be viewed in a longer term if your considering taking up a position unless you know what your doing. Volitility can wipe you out fast.

[…] Rick Falkvinge – What We Learn From This Bitcoin Correction: […]